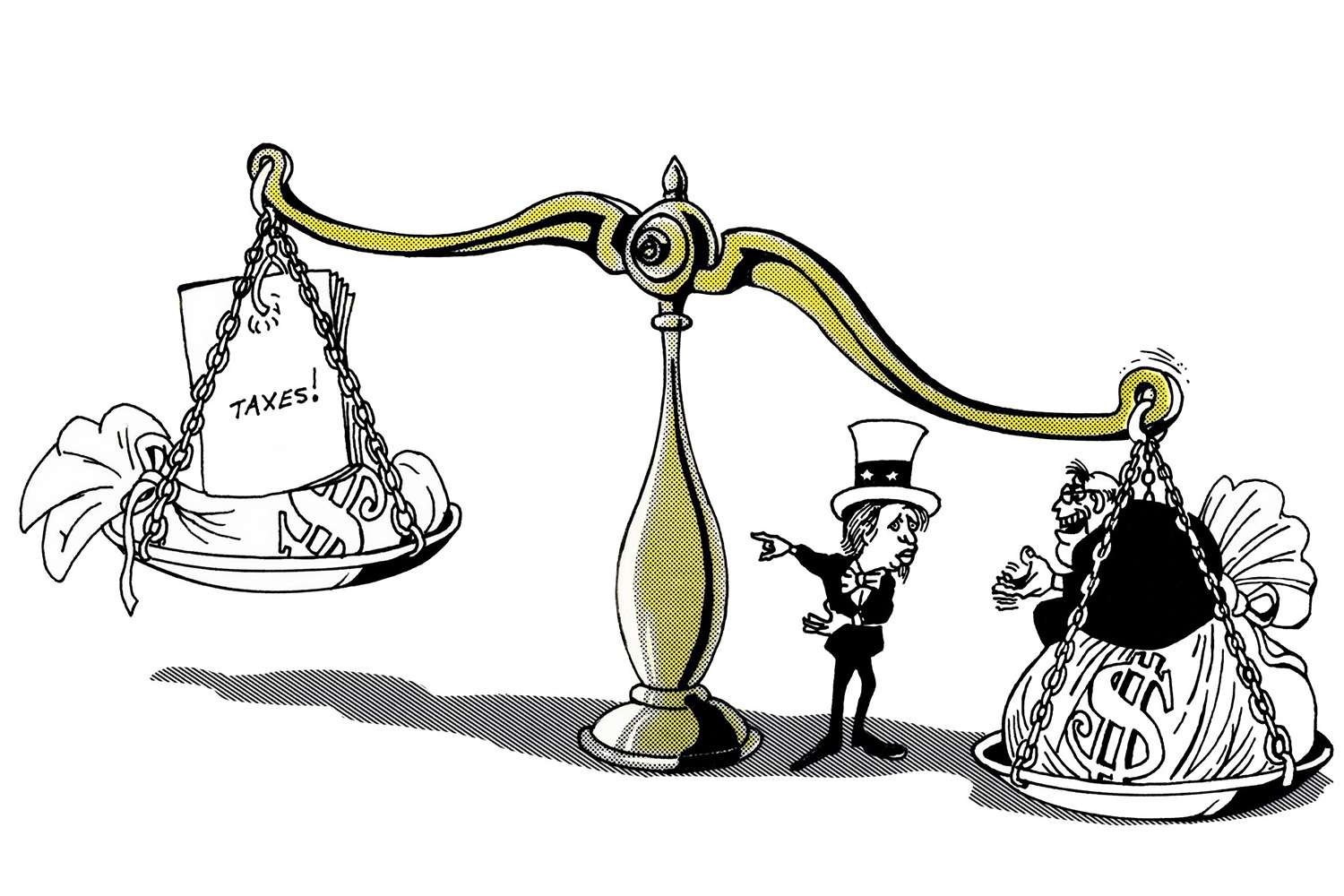

As the US struggles with both a weak banking system and persistently high inflation, it's time to take a serious look at the role of the Federal Reserve in this mess.

Still, in just one day, customers, mostly tech startups, withdrew $42 billion from the bank, leaving it with a negative cash balance of $958 million. This caused the parent company's stock to drop by more than 60%. Now, people are worried that SVB is just the first of many banks that will fail. On Friday, New York's Signature Bank went the same way as SVB.

As chaos continues to spread through the financial world in the wake of SVB's collapse, it's important to ask how the bank got into such a bad situation in the first place, saying out of the blue that it needed billions of dollars in funds. Even though pundits and officials have pointed the finger at a number of places, such as venture capitalists and diversity, equity, and inclusion, another US bank, the Federal Reserve, is often overlooked as a cause of SVB's spectacular rise and fall.

Even though the story is complicated and there are many people to blame, we can't ignore the role of the Federal Reserve and its expansionary monetary policy during the pandemic. SVB and other banks' unhealthy reliance on the Fed's unheard-of measures went downhill when interest rates started to rise. By looking at what the Fed and SVB did over the last few years, we can learn how to stop a similar-sized bank failure from happening again.

Loose Monetary Policy & Balance Sheets

During the pandemic, banks in the United States got a lot of cash because of the Fed's unmatched monetary policy. The Fed's actions increased the money supply by more than 40 percent in a little over two years by doing things like quantitative easing, setting up new lending facilities, and lowering interest rates to almost nothing.As a result of these actions, the total value of all the assets owned by commercial banks (banks that take money from the public, like SVB) went up by more than 27% as banks put most of their new cash into bonds like Treasury securities and mortgage-backed securities. For example, of SVB's total assets of $212 billion, $117 billion were in securities like those listed above.

Why ties? Because when interest rates go down, bond prices go up. So, when the Fed cut interest rates during the pandemic and bought trillions of dollars worth of bonds through quantitative easing (which raised the demand for bonds), the price of bonds went up sharply. Commercial banks saw that the value of bonds was going up and bought a lot of them so they could sell them later and make money from their rising value.

Even though both Treasury securities and mortgage-backed securities went up in value during the pandemic, the Fed had to raise interest rates quickly to stop prices from going up because of the huge increase in money supply. Since interest rates and bond prices go in the opposite direction, this meant that the value of the bonds that commercial banks held in large amounts dropped sharply.

More than other banks, this meant trouble for SVB. Bonds made up almost 43% of its assets, which had lost $15 billion by the end of 2022. Even though SVB was a big bank, it didn't have enough different types of assets and relied too much on tech startups, which are especially sensitive to interest rate increases. This made it prone to the Fed's sudden policy change.

The tech companies' withdrawals of deposits over the past year and SVB's growing inability to fund them because of its falling balance sheet hit a breaking point last week when the bank made its announcement, causing a bank run. Still, the sudden and quick fall of SVB could be bad news for other business banks.

The Federal Deposit Insurance Corporation (FDIC) says that by the end of 2022, US banks will have lost $620 billion on assets that have lost value but haven't been sold yet. Martin Gruenberg, the head of the FDIC, says,

"The current situation with interest rates has had a huge impact on how profitable and risky banks' funding and investment plans are... "Unrealized losses make it harder for a bank to meet unexpected liquidity needs in the future, like withdrawals of deposits that come out of the blue."

Drawing Conclusions

One important fact about SVB's failure and what it means for other business banks is that there is not just one person to blame. Sure, SVB could have spread its balance sheet more so that it wouldn't have lost as much money on its bonds. It could have also bought bonds with shorter terms that would have come due sooner. In fact, TechCrunch writer Connie Loizos may be correct when she says that Silicon Valley Bank "shoots itself in the foot."Gruenberg's comments, however, alluded to the fact that falling bond values have become a general threat to commercial banks' balance sheets. Signature Bank and Silvergate were both forced to close their doors in the last week because of falling balance sheets. In the middle of this worrying trend, the Fed may stand out as the main cause of what happened next. In a tweet, bank expert Christopher Walen thinks about:

"Is it possible that no one has asked Chair Powell about how QE (quantitative easing) is making US banks less stable? Where do you think the -$600 billion number will be at the end of Q1 23?"

The "-$600 billion number" refers to how much the FDIC thinks US banks have lost but not yet realized. Even though a change from a loose to a tight monetary policy could cause bonds to lose value, the Fed's unprecedented increase in the money supply through the purchase of trillions of dollars in securities may have pushed up their value artificially, making bonds look like a much better investment than they really were and tricking banks into buying a lot of them, which they are now losing money on.

As the US struggles with both a weak banking system and continuously high levels of inflation, it's important to question the Fed's lack of restraint in printing so much money during the pandemic. But it remains to be seen if the central bank will be able to see and learn from its past mistakes.