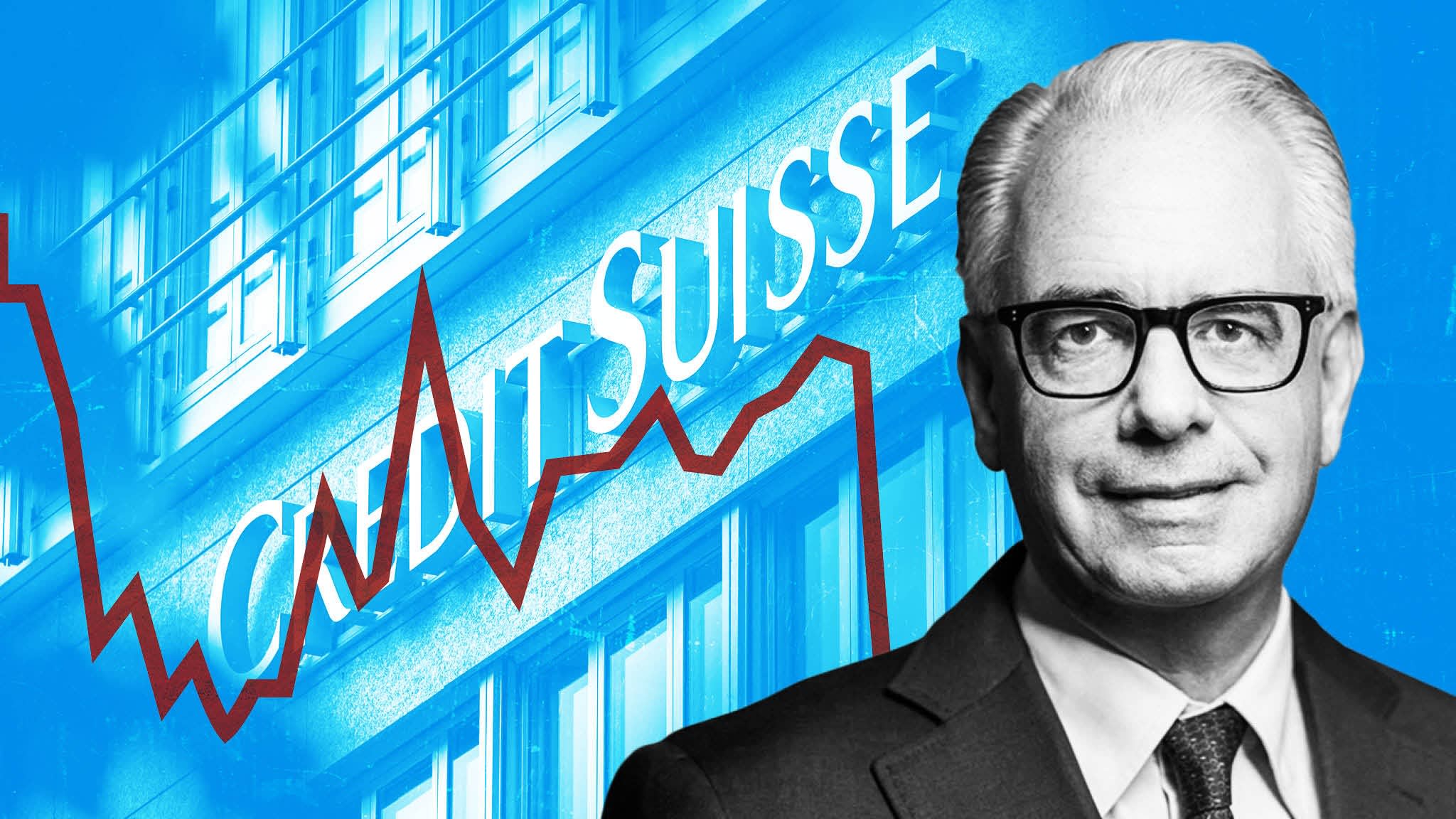

Michael Klein plans merger with Credit Suisse investment bank

Former Citigroup executive Michael Klein is hunting for investors as he aims to combine his boutique advisory firm with Credit Suisse’s investment bank, which the Swiss lender has entrusted to its former board member as part of a radical restructuring.

Klein hopes to complete a deal for the newly formed CS First Boston by the middle of next year and plans to structure it as a spin-off and merger of Credit Suisse’s capital markets and advisory business with M Klein & Company, according to people familiar with the matter.

Credit Suisse will own a majority stake but Klein plans to acquire a substantial shareholding in CS First Boston, say the same people.

Klein has advised Barclays on its purchase of Lehman Brothers during the financial crisis, helped to broker the deal between mining groups Glencore and Xstrata, worked on the huge Dow-Dupont merger and has built close ties in Saudi Arabia. He was one of the kingdom’s advisers on the Saudi Aramco initial public offering and has worked closely with sovereign Public Investment Fund, which is one of the largest shareholders in the SNB.

This story originally appeared on: Financial Times - Author:Owen Walker