Barclays: bank sees no problems but prepares for them anyway

Speaking out of both sides of one’s mouth is a proficiency all British bank bosses quickly master. Barclays’ CS Venkatakrishnan emphasised the positives from Wednesday’s third-quarter results in earnings calls. He just avoided doing so too emphatically.

The UK-based lender would not want hefty profitability to attract the attention of a beady-eyed new government. Ministers might slap fresh windfall taxes on the sector.

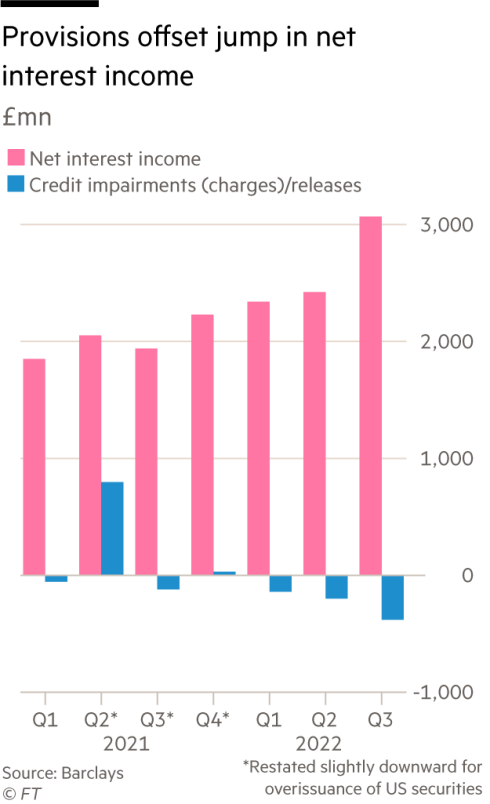

In the event, Barclays delivered a conveniently mixed result. Quarterly profits before tax of £2bn beat consensus numbers from Visible Alpha, an estimates service, by 9 per cent. What stood out was the strong 63 per cent jump in dollar revenues from the fixed-income group within Barclays’ securities trading arm.

But that did not boost shares — trading on just half tangible book value — which fell more than local peers on the day.

This story originally appeared on: Financial Times - Author:Tax Cognition