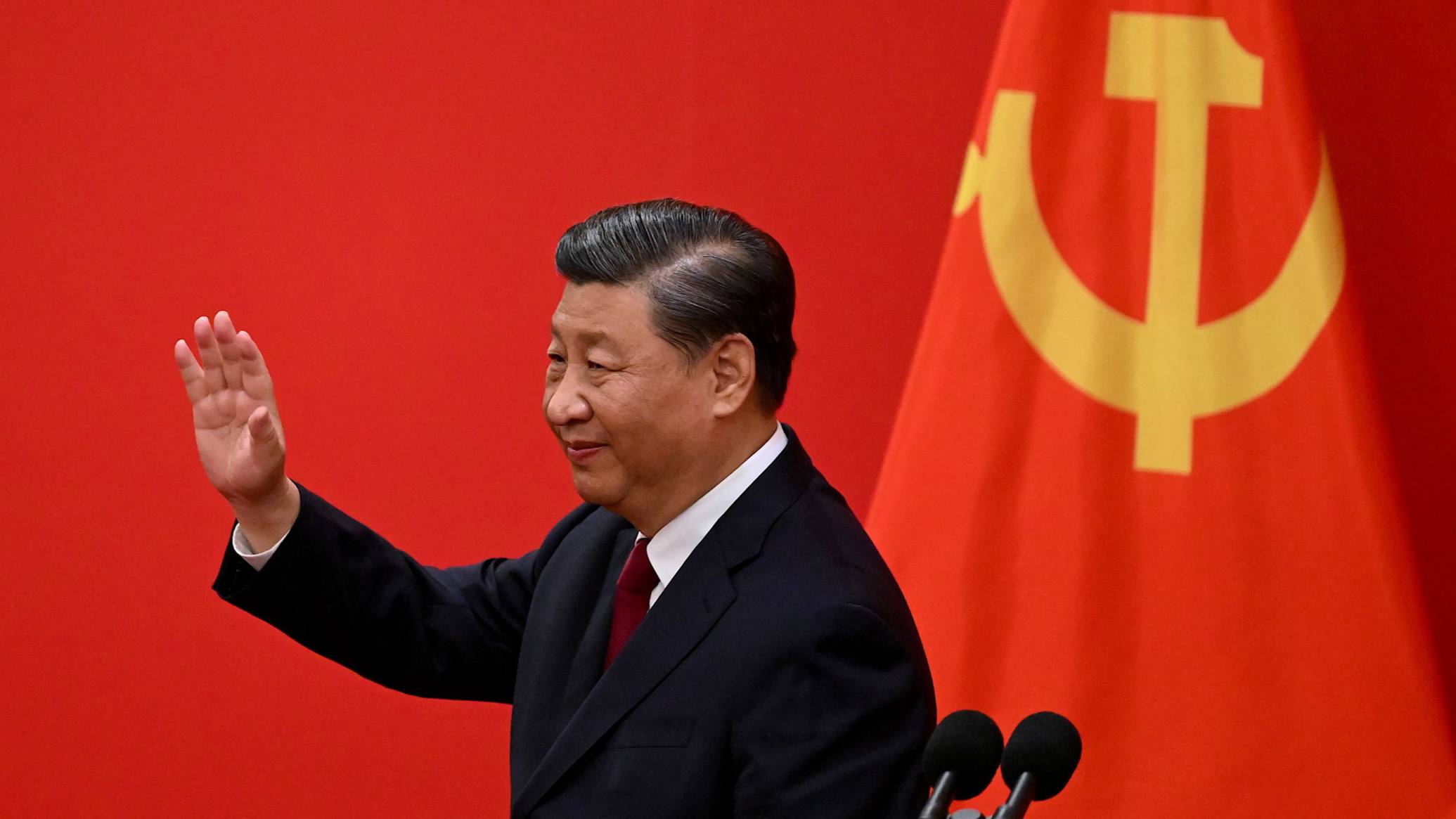

China bulls hammered by stock rout as Xi Jinping consolidates power

The dramatic sell-off in Chinese markets that followed confirmation of President Xi Jinping’s third term in power hammered stocks popular with big fund managers, suggesting billions of dollars of losses for those who stuck by their portfolios.

The Nasdaq Golden Dragon index, which tracks US-listed shares in Chinese companies, shed 14.4 per cent on Monday in its largest one-day fall on record, bringing its decline to about 50 per cent this year. Stocks such as Alibaba, JD.com and Pinduoduo all tumbled.

Chase Coleman’s hedge fund Tiger Global, Edinburgh-based investment group Baillie Gifford and a group tied to Berkshire Hathaway vice-chair Charlie Munger are among investors with large holdings of Chinese stocks.

The Alibaba stake was valued at more than $70mn after the Daily Journal bought more than 600,000 shares at the end of last year. By September 30 it had cut its stake to 300,000 shares worth about $24mn, according to filings.

In recent quarters the Daily Journal had borrowed on margin to invest in a stock portfolio which also includes stakes in Bank of America, Wells Fargo and South Korean steelmaker Posco, according to public disclosures and comments by Munger at the Daily Journal’s February 2022 annual meeting.

This story originally appeared on: Financial Times - Author:Ortenca Aliaj