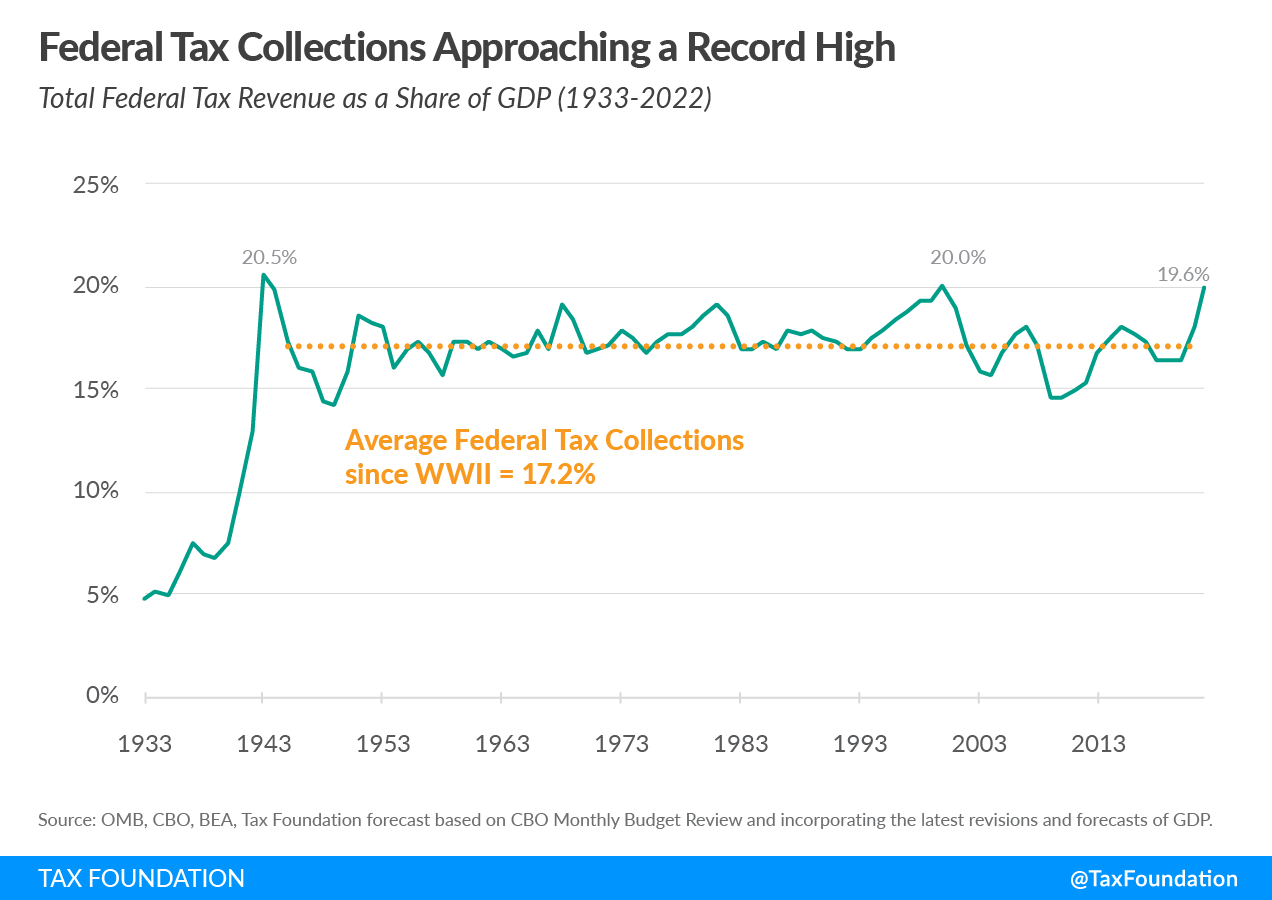

Federal tax revenues are approaching the highest levels in U.S. history, which were reached during World War II and again during the dot-com boom of 2000. In FY 2022, federal spending hit 25% of GDP, a level only surpassed during the height of the pandemic in 2020 and 2021 and World War II.

In FY 2022, federal tax revenue as a percentage of GDP is projected to reach a multi-decade high of approximately 19.6 percent, up from 17.9 percent in FY 2021 and approaching the 20 percent mark reached during the dot-com boom in FY 2000. In only two other years in U.S. history have federal tax collections been higher than they are this year, both of which occurred during World War II: in 1943, federal tax revenues hit 20,5% of GDP before declining to 19,9% in 1944. Compared to the average post-war federal tax collections of 17.2 percent of GDP, this year's receipts are projected to surpass that level by 2.4 percentage points. Individual income tax receipts increased the greatest during the current fiscal year, increasing by 29 percent from $2.0 trillion to $2.6 trillion, an increase of $600 billion. This may be partially attributable to the capital gains generated by last year's surging stock and housing markets. This year, payroll taxes have increased by 13 percent, from $1.3 trillion to $1.5 trillion, while corporation taxes have increased by 14 percent, from $372 billion to $425 billion. Other income is up 13% from $316 billion to $356 billion.

Extreme economic volatility in previous years makes it difficult to analyze the impact of the 2017 Tax Cuts and Jobs Act (TCJA) on tax receipts. Among other modifications, the TCJA lowered the corporate tax rate from 35% to 21%. During the first year of the epidemic, corporate and other government tax collections were relatively low in 2018, but have subsequently returned with the economy and inflation. In the five years since the introduction of the TCJA, federal tax collections have averaged 17.3 percent of GDP, which is higher than the 16.7 percent predicted by the CBO following its approval, higher than most years before to the TCJA, and higher than the postwar average of 17.2 percent.

Note that current tax receipts do not reflect the tax adjustments adopted last month as part of the Inflation Reduction Act (IRA), which take into effect for the most part on January 1, 2023. We predict that the IRA will raise gross revenues by around $28 billion in 2023, which will be somewhat offset by tax credits totaling $39 billion, which is negligible compared to the budgetary consequences of inflation and a recovering economy.

It remains to be seen where tax income will go in the future, but it will undoubtedly rely on the path of the economy and inflation, as well as the impact of any policy changes on both. This emphasizes the need for politicians to at least attempt to consider these effects when assessing policy tradeoffs.

The CBO reports that despite a substantial increase in tax receipts during the fiscal year 2022, federal spending substantially exceeded this amount. Total expenditures were $6.3 trillion, resulting in a $1.4 trillion deficit. Thus, expenditures were almost 25,1 percent of GDP, a figure only surpassed during the height of the pandemic in 2020 and 2021 and World War II.

These grim statistics should give pause to our political representatives. Record federal tax receipts on top of soaring prices — essentially an additional inflation tax paid by everyone who uses dollars — should not be used to justify more spending. In fact, excessive spending in response to the pandemic is driving inflation, and rather than expanding costly aid programs (such as student loan forgiveness), we should be reducing them. Taxpayers should demand a halt to pandemic emergency spending now that the pandemic emergency has passed, and that their tax monies be spent more prudently or refunded to them.